Live TV Streaming Service Delivers Double Digit Revenue, Subscription and Viewership Growth Year-Over-Year

NEW YORK--(BUSINESS WIRE)--

fuboTV Inc. (OTCQB: FUBO), previously FaceBank Group, Inc., today has filed Form 8K to include the unaudited financial results of the combined company for the second quarter ended June 30, 2020. These are the first quarterly results reported since FaceBank’s merger with fuboTV Inc. which was completed in April 2020.

This press release features multimedia. View the full release here: https://www.businesswire.com/news/home/20200813005707/en/

(Graphic: Business Wire)

Second Quarter Financial Highlights

-

Revenues for the second quarter 2020 were $44.2 million, a 53% increase year-over-year on a pro forma basis. This growth was driven by continued subscriber growth, an increase in subscription Average Revenue Per User (ARPU) and growth of advertising sales:

-

Subscription revenue increased 51% year-over-year to $39.5 million.

-

Advertising revenue increased 71% year-over-year to $4.3 million.

-

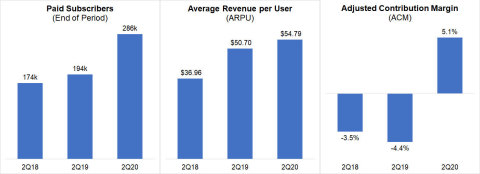

Paid subscribers at quarter end totaled 286,126, an increase of 47% year-over-year.

-

Average Revenue Per User (ARPU) per month was $54.79, up 8% year-over-year.

-

Total content hours streamed by fuboTV users (paid and free trial) increased 83% year-over-year to 98.6 million hours.

-

Monthly active users (MAUs) watched 140 hours per month on average in the quarter, an increase of 54% year-over-year.

(Note: The company states its key metrics on a year-over-year basis, given the seasonality of sports content. As the legacy FaceBank business reported no revenue in the second quarter of 2019 and 2020, the comparisons to prior year shown in this document refer to the pro forma 2019 results of the consolidated legacy fuboTV and FaceBank business, unless otherwise stated).

“We delivered strong second quarter results - revenues grew 53% year-over-year, fuboTV paid subscribers increased 47% and content hours streamed increased 83% year-over-year,” said David Gandler, co-founder and CEO, fuboTV. “Consumer engagement continued to be strong in Q2, despite a shutdown of most major league sports both in the U.S. and internationally, and we successfully ramped up advertising revenue.”

“We believe consumers will continue to choose streaming over traditional pay television, especially in the current economic climate because of its more personalized, premium viewing experience. Macro trends towards streaming, combined with our strong second quarter results and continued momentum, reinforce our confidence in our business and the vMVPD space. Looking ahead to Q3, with the gradual return of sports, we anticipate an increase in subscribers, viewership and that our portion of revenue derived from advertising will grow. At the close of Q3 we expect paid subscribers to reach 340,000 - 350,000, which will be an increase of 20% year-over-year. The growth of streaming is one of the most significant changes to television, and television advertising, in the last several decades. fuboTV is at the forefront of the streaming revolution and we are excited for existing and new investors to join us on this journey,” added Gandler.

In a letter released to shareholders today, Gandler described in greater detail the results of the recently completed second quarter and the business. The complete shareholder letter is below.

FUBOTV CEO David Gandler’s Letter to Shareholders

August 13, 2020

Fellow Shareholders,

Q2 was extremely productive for the combined fuboTV/FaceBank business and I’m pleased to share our Q2 2020 unaudited financial results and recent business updates with you today. As highlighted in my previous Shareholder Letters, we completed the merger of fuboTV and FaceBank Group, Inc. in April 2020. The company has changed its legal name to fuboTV Inc. and has applied to FINRA to process this name change on the OTC Markets. We encourage you to read our full set of financial statements and SEC filings, and to sign up for email alerts, on the investor relations section of our website at ir.fubo.tv.

fuboTV currently trades on the OTC market under the symbol “FUBO.” fuboTV is also working to list on a national securities exchange.

As is customary with mergers, we have a large number of SEC filings. We have made significant progress and are focusing our comments today on the go-forward strategy and business of the company, which is fuboTV.

The growth of streaming is one of the most significant changes to television, and television advertising, in the last several decades.

We continue to believe fuboTV is at the forefront of the streaming revolution. fuboTV is the leading sports-first, live TV streaming platform, offering subscribers access to tens of thousands of live sporting events annually as well as leading news and entertainment content. At the core of our offering is our proprietary technology platform optimized for live TV and sports viewership. Our proprietary technology stack has enabled us to regularly offer new features and functionality. For example, we were the first vMVPD to stream in 4K resolution. We also offer multi-view on Apple TV, which enables subscribers to watch two live streams simultaneously, as well as the ability to watch select sports content from multiple camera angles.

We believe consumers will, particularly in this current economic climate, continue to choose streaming over traditional pay television because of this more personalized, premium viewing experience that is also less expensive.

Consumer engagement continued to be strong in Q2, despite a shutdown of most major league sports both in the U.S. and internationally. News and entertainment viewership grew as subscribers looked to stay informed and entertained during the ongoing COVID-19 pandemic, with live sports returning toward the end of the quarter. As previously announced, viewing hours on fuboTV peaked at 8.5 hours/day while consumers were sheltering at home. We believe this increased engagement during the pandemic solidifies the consumer appeal of streaming versus more expensive traditional cable television viewing.

The company has been focused on strengthening its balance sheet. As previously announced, we added $46 million in equity funding from institutional and private investors, including Credit Suisse Capital, LLC.

Q2 2020 Financial and Recent Operating Highlights

Our key metrics should be considered on a year-over-year basis given the seasonality of sports content. Sports content has historically contributed to higher subscription revenue and subscriber additions in the third and fourth quarters, and slower growth in the first and second quarters. For example, in 2018 and 2019, our third and fourth quarters combined represented 60% and 65% of our total gross paid subscriber additions, respectively. To take advantage of the higher levels of purchase intent in the second half of the year, we have historically incurred the majority of our sales and marketing expenses in these periods. While we are working on multiple initiatives that leverage FaceBank’s IP, technology and assets, we expect the monetization of these assets will require a few more quarters. Please note that, as the legacy FaceBank business reported no revenue in the second quarter of 2019 and of 2020, the comparisons to prior year shown below refer to the pro forma 2019 results.

-

Revenues for the second quarter 2020 were $44.2 million, a 53% increase year-over-year on a pro forma basis. This growth was driven by continued subscriber growth, an increase in subscription Average Revenue Per User (ARPU) and growth of advertising sales:

-

Subscription revenue increased 51% year-over-year to $39.5 million.

-

Advertising revenue increased 71% year-over-year to $4.3 million.

-

Paid subscribers at quarter end totaled 286,126, an increase of 47% year-over-year.

-

Average Revenue Per User (ARPU) per month was $54.79, up 8% year-over-year.

-

Total content hours streamed by fuboTV users (paid and free trial) increased 83% year-over-year to 98.6 million hours.

-

Monthly active users (MAUs) watched 140 hours per month on average in the quarter, an increase of 54% year-over-year.

-

We use adjusted contribution margin to measure the variable costs against subscriber revenue: adjusted contribution margin was positive 5.1% in Q2 2020, up from negative (4.4)% in Q2 2019. The improvement was driven by growth in subscription ARPU, growth in advertising ARPU and a decline in average cost per user (ACPU) due to lower per-subscriber content expenses. Please refer to the reconciliation of revenue to adjusted contribution margin in the non-GAAP information in the tables accompanying this letter.

-

Total operating expenses in the period were $111.5 million, or $86.1 million excluding stock-based compensation, one-time non-cash operating expenses, Depreciation and Amortization (please refer to reconciliation of operating expenses to adjusted operating expenses in the tables accompanying this letter). Of these $86.1 million expenses, the main drivers and variances compared to the 2Q 2019 pro forma were:

-

Subscriber related expenses totaled $53.1 million, an increase of $9.1 million.

-

Sales and marketing expenses totaled $6.4 million (or $7.6 million including stock-based compensation), a decrease of $0.6 million.

-

General and administrative expenses totaled $8.2 million (or $17.3 million including stock-based compensation and one-time non-cash operating expenses), an increase of $5.4 million including transaction costs.

-

The company generated a net loss of $99.8 million in Q2 2020.

-

Adjusted EBITDA was a loss of $41.9 million in Q2 2020, a $1.5 million larger loss than in the prior year. Please refer to the reconciliation of net loss to adjusted EBITDA in the tables accompanying this letter.

-

We ended the June 30, 2020 quarter with $8.7 million in cash.

-

On July 10, 2020 we successfully completed the disposition of Facebank AG, FaceBank’s legacy European business.

Since April, we’ve added $46 million in equity funding from institutional and private investors. This includes $26 million closed during the second quarter of the year, and a transaction with Credit Suisse Capital to invest $20 million at a purchase price of $9.25 per share that we closed on July 2 and will therefore be reflected in our Q3 financials.

Recent Business Highlights

-

Named renowned media executive Edgar Bronfman Jr. to lead our Board of Directors as executive chair. He is the former chairman and CEO of Warner Music. Also joining our Board of Directors:

-

Henry Ahn, who currently leads distribution for Univision Communications and has led distribution for Scripps Interactive and NBC Universal;

-

Ignacio “Nacho” Figueras, entrepreneur, investor and polo player/team owner;

-

Daniel Leff, founder of media-focused venture capital firms Luminari Capital and Waverley Capital, and an early investor in Roku and its former Board Director for several years; and

-

Par-Jorgen Parson, Spotify’s earliest investor and its former Board Director of 10 years.

-

Appointed three key leaders to our executive management team: Simone Nardi as chief financial officer, Diana Horowitz as senior vice president, advertising sales and, more recently, Gina DiGioia Sheldon as our first in-house general counsel.

-

Closed a multi-year carriage agreement with Disney Media Networks for distribution of ESPN (all channels) and Walt Disney Television networks (ABC, Disney Channel, Freeform, FX, Nat Geo, etc.). All of these channels launched in August.

-

Grew our international sports and entertainment offering with the French-language TV5Monde USA network and our lifestyle programming with Tastemade’s linear TV channel aimed at Millennials. Both channels launched in June.

-

Expanded fuboTV’s distribution to Xbox One’s family of devices, making fuboTV available on gaming consoles for the first time.

-

Grew our ad-supported linear sports channel fubo Sports Network with new content, talent and distribution agreements.

-

Expanded distribution to Pluto TV, the leading free streaming television service in America.

-

Entered into an exclusive agreement with 3X NBA All-Star Gilbert Arenas to reimagine his popular podcast as a weekly original talk show retitled No Chill With Gilbert Arenas.

-

While U.S. major sports leagues stayed on pause in the second quarter, fubo Sports Network partnered with several domestic and international leagues to bring live sports back to fans. These included matches from Russian mixed martial arts league M-1 Global and playoff games from the Constellation Energy League (with independent baseball teams managed by baseball greats Roger Clemens, Greg Swindell, Pete Incaviglia and Dave Eiland) and the Israeli Winners League (featuring former NBA players such as Amar’e Stoudemire).

Guidance

Looking ahead, we are focused on driving both top-line growth and making progress on our path to profitability. Our financial model is driven by strong unit economics, and we expect margin improvement to continue over time, aided by a number of initiatives, including the growth of advertising on our platform along with strong attachment rates on value-added services, including cloud DVR storage and the ability to view multiple streams. We expect the recent addition of the Disney Media Networks to our programming portfolio to help grow our subscription and advertising revenue. Furthermore, we believe fuboTV’s differentiation in the marketplace - sports-focused programming and a tech-first user experience - firmly positions the company strongly for growth.

Our strong second quarter, including continued growth and improved profitability, reinforces our confidence in our business and the vMVPD space. With the return of sports, we anticipate an increase in revenue - both subscriptions and advertising - and viewership during Q3. We believe this also sets up a unique interactive wagering opportunity for the company. Furthermore, we believe the addition of Disney Media Networks, including ESPN, ABC and Disney Channel, alongside our current channel lineup will make fuboTV even more appealing to the entire household and in particular sports fans. With Disney, fuboTV is expected to have the most complete NFL game coverage of any vMVPD.

At the close of the third quarter, we anticipate strong paid subscriber growth and expect to have reached 340,000-350,000 total subscriptions, representing growth of over 20% year-over-year. While the advertising market is unsure given the pandemic, we expect that advertising will become a more meaningful part of our business moving forward, and a greater percentage of our overall revenue mix.

It is important to note that there continues to be uncertainty around the return of live sports, specifically college football and the NFL due to the ongoing pandemic. We have factored in ongoing uncertainty around the fall sports calendar in our subscriber guidance.

Summary

The strength of the streaming business during the pandemic is a clear sign that vMVPDs have a bright future. fuboTV’s solid second quarter validated our belief that consumers are seeking lower cost alternatives to traditional television. Our streaming hours grew over the prior year despite a near total shutdown of sports. This is primarily a result of fuboTV’s expanded programming offering for the entire family combined with product innovations that deliver a premium viewing experience not available through traditional television. We expect streaming hours to grow as sports return. And, with the recent (August) addition of Disney Media Networks, including ESPN, to our offering, fuboTV has a market-leading 43 of the top 50 Nielsen-ranked sports, news and entertainment networks as well as significant coverage of soccer, NFL, NBA, NHL, MLB and college sports.

We continue to be very excited about fuboTV’s future and the strength of our company. We believe fuboTV is at the forefront of the streaming revolution in the $226 billion pay TV services market and are excited for existing and new investors to join us on this journey.

Sincerely,

David Gandler, co-founder and CEO

More Information

Additional information is available at www.sec.gov under fuboTV Inc.’s filings, as well as https://ir.fubo.tv and https://ir.facebankgroup.com/.

fuboTV intends to use its website as a disclosure channel and investors are encouraged to refer to it, as well as press releases and SEC filings. The company encourages reading the full set of financial statements, including, pro forma financial statements for the combined company, and related disclosures, as filed in its Form 10-Q for the quarter ended June 30, 2020 to be filed this week.

About fuboTV

fuboTV (OTCQB: FUBO) is the leading sports-first live TV streaming platform offering subscribers access to tens of thousands of live sporting events annually as well as leading news and entertainment content. fuboTV’s base package, fubo Standard, features a broad mix of 100+ channels, including 43 of the top 50 Nielsen-ranked networks across sports, news and entertainment (Primetime A18-49).

Continually innovating to give subscribers a premium viewing experience they can’t find with cable TV, fuboTV is regularly first-to-market with new product features and was the first virtual MVPD to stream in 4K.

fuboTV merged with FaceBank Group in April 2020 to create a leading digital entertainment company, combining fuboTV’s direct-to-consumer live TV streaming platform for cord-cutters with FaceBank’s technology-driven IP in sports, movies and live performances.

Forward-Looking Statements

This letter contains forward-looking statements of fuboTV Inc. (“fuboTV”) that involve substantial risks and uncertainties. All statements contained in this press release are forward-looking statements within the meaning of The Private Securities Litigation Reform Act of 1995. The words “could,” “will,” “plan,” “intend,” “anticipate,” “approximate,” “expect,” “potential,” or the negative of these terms or other similar expressions are intended to identify forward-looking statements, although not all forward-looking statements contain these identifying words. Actual results or events could differ materially from the plans, intentions and expectations disclosed in the forward-looking statements that fuboTV makes due to a number of important factors, including (i) risks related to the ability to realize the anticipated benefits of the merger, (ii) risks related to the combined entity’s access to capital and fundraising prospects to fund its ongoing operations and its ability to continue as a “going concern”, (iii) risks related to the combined entity’s ability to uplist to a national securities exchange, (iv) risks related to diverting management’s attention from fuboTV’s ongoing business operations to address integration and fundraising efforts, and (v) other business effects, including the effects of industry, market, economic, political or regulatory conditions, future exchange and interest rates, and changes in tax and other laws, regulations, rates and policies, including the impact of COVID-19 on the broader market. Further risks that could cause actual results to differ materially from those matters expressed in or implied by such forward-looking statements are discussed in the company’s periodic filings with the Securities and Exchange Commission and we encourage you to read such risks in detail. The forward-looking statements in this press release represent fuboTV’s views as of the date of this press release. fuboTV anticipates that subsequent events and developments will cause its views to change. However, while it may elect to update these forward-looking statements at some point in the future, it specifically disclaims any obligation to do so. You should, therefore, not rely on these forward-looking statements as representing fuboTV’s views as of any date subsequent to the date of this letter.

(fuboTV Inc. Financial Statements begin on the following pages)

|

fuboTV Inc.

Condensed Consolidated Statements of Operations and Comprehensive Loss

(Unaudited)

(in thousands, except share and per share amounts)

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended June 30,

|

|

|

Six Months Ended June 30,

|

|

|

|

|

2020

|

|

|

2019

|

|

|

2020

|

|

|

2019

|

|

|

Revenues, net

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Subscriptions

|

|

$

|

39,511

|

|

|

$

|

—

|

|

|

$

|

39,511

|

|

|

$

|

—

|

|

|

Advertisements

|

|

|

4,323

|

|

|

|

—

|

|

|

|

4,323

|

|

|

|

—

|

|

|

Software licenses, net

|

|

|

—

|

|

|

|

—

|

|

|

|

7,295

|

|

|

|

—

|

|

|

Other

|

|

|

338

|

|

|

|

—

|

|

|

|

338

|

|

|

|

—

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total Revenues

|

|

$

|

44,172

|

|

|

$

|

—

|

|

|

$

|

51,467

|

|

|

$

|

—

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Operating expenses:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Subscriber related expenses

|

|

|

53,087

|

|

|

|

—

|

|

|

|

53,087

|

|

|

|

—

|

|

|

Broadcasting and transmission

|

|

|

9,492

|

|

|

|

—

|

|

|

|

9,492

|

|

|

|

—

|

|

|

Sales and marketing

|

|

|

7,577

|

|

|

|

111

|

|

|

|

11,256

|

|

|

|

324

|

|

|

Technology and development

|

|

|

9,551

|

|

|

|

—

|

|

|

|

9,551

|

|

|

|

—

|

|

|

General and administrative

|

|

|

17,338

|

|

|

|

693

|

|

|

|

33,862

|

|

|

|

1,517

|

|

|

Depreciation and amortization

|

|

|

14,417

|

|

|

|

5,158

|

|

|

|

19,637

|

|

|

|

10,316

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total operating expenses

|

|

|

111,462

|

|

|

|

5,962

|

|

|

|

136,885

|

|

|

|

12,157

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Operating loss

|

|

|

(67,290

|

)

|

|

|

(5,962

|

)

|

|

|

(85,418

|

)

|

|

|

(12,157

|

)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Other income (expense):

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Interest expense and financing costs

|

|

|

(13,325

|

)

|

|

|

(454

|

)

|

|

|

(15,906

|

)

|

|

|

(900

|

)

|

|

Loss on deconsolidation of Nexway

|

|

|

—

|

|

|

|

—

|

|

|

|

(11,919

|

)

|

|

|

—

|

|

|

Loss on issuance of notes, bonds and warrants

|

|

|

(26,753

|

)

|

|

|

—

|

|

|

|

(50,806

|

)

|

|

|

—

|

|

|

Change in fair value of warrant liabilities

|

|

|

4,966

|

|

|

|

—

|

|

|

|

4,600

|

|

|

|

—

|

|

|

Change in fair value of subsidiary warranty liability

|

|

|

18

|

|

|

|

1,124

|

|

|

|

3

|

|

|

|

3,601

|

|

|

Change in fair value of shares settled liability

|

|

|

(1,485

|

)

|

|

|

—

|

|

|

|

(1,665

|

)

|

|

|

—

|

|

|

Change in fair value of derivative liabilities

|

|

|

(823

|

)

|

|

|

890

|

|

|

|

(526

|

)

|

|

|

1,018

|

|

|

Change in fair value of profit share liability

|

|

|

(148

|

)

|

|

|

—

|

|

|

|

(148

|

)

|

|

|

—

|

|

|

Unrealized gain on equity method investment

|

|

|

2,614

|

|

|

|

—

|

|

|

|

2,614

|

|

|

|

—

|

|

|

Other expense

|

|

|

(1,010

|

)

|

|

|

—

|

|

|

|

(1,446

|

)

|

|

|

—

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total other (expense) income

|

|

|

(35,946

|

)

|

|

|

1,560

|

|

|

|

(75,199

|

)

|

|

|

3,719

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Loss before income taxes

|

|

|

(103,236

|

)

|

|

|

(4,402

|

)

|

|

|

(160,617

|

)

|

|

|

(8,438

|

)

|

|

Income tax benefit

|

|

|

3,481

|

|

|

|

1,037

|

|

|

|

4,519

|

|

|

|

2,206

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net loss

|

|

$

|

(99,755

|

)

|

|

$

|

(3,365

|

)

|

|

$

|

(156,098

|

)

|

|

$

|

(6,232

|

)

|

|

Less: net (loss) income attributable to non-controlling interest

|

|

|

(682

|

)

|

|

|

2,182

|

|

|

|

(1,555

|

)

|

|

|

2,781

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net loss attributable to controlling interest

|

|

$

|

(99,073

|

)

|

|

$

|

(5,547

|

)

|

|

$

|

(154,543

|

)

|

|

$

|

(9,013

|

)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Less: Deemed divided – beneficial conversion feature on preferred stock

|

|

|

—

|

|

|

|

—

|

|

|

|

171

|

|

|

|

—

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net loss attributable to common stockholders

|

|

$

|

(99,073

|

)

|

|

$

|

(5,547

|

)

|

|

$

|

(154,714

|

)

|

|

$

|

(9,013

|

)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net loss per share attributable to common stockholders:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic and diluted

|

|

$

|

(2.82

|

)

|

|

$

|

(0.24

|

)

|

|

$

|

(4.77

|

)

|

|

$

|

(0.50

|

)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Weighted average shares outstanding:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic and diluted

|

|

|

35,045,390

|

|

|

|

22,964,199

|

|

|

|

32,390,829

|

|

|

|

17,952,188

|

|

|

fuboTV Inc.

Condensed Consolidated Balance Sheets

(in thousands, except for share and per share information)

|

|

|

|

|

|

|

|

|

|

|

|

|

June 30, 2020

|

|

|

December 31, 2019

|

|

|

|

|

|

(unaudited)

|

|

|

*

|

|

|

|

ASSETS

|

|

|

|

|

|

|

|

|

|

|

Current assets:

|

|

|

|

|

|

|

|

|

|

|

Cash and cash equivalents

|

|

$

|

|

|

7,356

|

|

$

|

7,624

|

|

|

|

Accounts receivable, net

|

|

|

4,112

|

|

|

|

8,904

|

|

|

|

Prepaid expenses and other current assets

|

|

|

2,839

|

|

|

|

1,445

|

|

|

|

Assets held for sale (Note 7)

|

|

|

35,494

|

|

|

|

—

|

|

|

|

Total current assets

|

|

|

49,801

|

|

|

|

17,973

|

|

|

|

Property and equipment, net

|

|

|

|

|

1,933

|

|

|

335

|

|

|

|

Restricted cash

|

|

|

1,330

|

|

|

|

—

|

|

|

|

Financial assets at fair value

|

|

|

—

|

|

|

|

1,965

|

|

|

|

Intangible assets, net

|

|

|

340,785

|

|

|

|

116,646

|

|

|

|

Goodwill

|

|

|

710,962

|

|

|

|

227,763

|

|

|

|

Operating leases – right-of-use assets

|

|

|

5,152

|

|

|

|

3,519

|

|

|

|

Other non-current assets

|

|

|

403

|

|

|

|

24

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total assets

|

|

$

|

1,110,366

|

|

|

$

|

368,225

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Liabilities, convertible preferred stock and stockholders’ equity

|

|

|

|

|

|

|

|

|

|

|

Current liabilities:

|

|

|

|

|

|

|

|

|

|

|

Accounts payable, accrued expenses and other current liabilities

|

|

$

|

109,404

|

|

|

$

|

56,775

|

|

|

|

Accounts payable – due to related parties

|

|

|

17,010

|

|

|

|

665

|

|

|

|

Accrued expenses – due to related parties

|

|

|

43,170

|

|

|

|

—

|

|

|

|

Notes payable, net of discount

|

|

|

16,542

|

|

|

|

4,090

|

|

|

|

Note payable – related parties

|

|

|

539

|

|

|

|

368

|

|

|

|

Convertible notes, net of $2,027 and $710 discount as of June 30, 2020 and December 31, 2019, respectively

|

|

|

4,407

|

|

|

|

1,358

|

|

|

|

Shares settled liability for intangible asset

|

|

|

—

|

|

|

|

1,000

|

|

|

|

Deferred revenue

|

|

|

8,855

|

|

|

|

—

|

|

|

|

Profit share liability

|

|

|

2,119

|

|

|

|

1,971

|

|

|

|

Warrant liability – subsidiary

|

|

|

21

|

|

|

|

24

|

|

|

|

Warrant liabilities

|

|

|

40,617

|

|

|

|

—

|

|

|

|

Derivative liabilities

|

|

|

163

|

|

|

|

376

|

|

|

|

Long term borrowings – current portion

|

|

|

8,154

|

|

|

|

—

|

|

|

|

Current portion of operating lease liabilities

|

|

|

970

|

|

|

|

815

|

|

|

|

Liabilities held for sale (Note 7)

|

|

|

56,137

|

|

|

|

—

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total current liabilities

|

|

|

308,108

|

|

|

|

67,442

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Deferred income taxes

|

|

|

90,794

|

|

|

|

30,879

|

|

|

|

Operating lease liability

|

|

|

4,189

|

|

|

|

2,705

|

|

|

|

Long term borrowings

|

|

|

19,197

|

|

|

|

43,982

|

|

|

|

Other long-term liabilities

|

|

|

1

|

|

|

|

41

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total liabilities

|

|

|

422,289

|

|

|

|

145,049

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Commitments and contingencies (Note 19)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Series D Convertible Preferred stock, $0.0001 par value, 2,000,000 shares authorized, 203,000 and 456,000 shares issued and outstanding at June 30, 2020 and December 31, 2019, respectively; aggregate liquidation preference of $208 and $462 as of June 30, 2020 and December 31, 2019, respectively

|

|

|

208

|

|

|

|

462

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Stockholders’ equity:

|

|

|

|

|

|

|

|

|

|

|

Series AA Convertible Preferred stock, par value $0.0001, 35,800,000 shares authorized, 27,412,193 and 0 shares issued and outstanding as of June 30, 2020 and December 31, 2019, respectively

|

|

|

566,124

|

|

|

|

—

|

|

|

|

Series A Preferred stock, par value $0.0001, 5,000,000 shares authorized, 0 shares issued and outstanding as of June 30, 2020 and December 31, 2019, respectively

|

|

|

—

|

|

|

|

—

|

|

|

|

Series B Convertible Preferred stock, par value $0.0001, 1,000,000 shares authorized, 0 shares issued and outstanding as of June 30, 2020 and December 31, 2019, respectively

|

|

|

—

|

|

|

|

—

|

|

|

|

Series C Convertible Preferred stock, par value $0.0001, 41,000,000 shares authorized, 0 shares issued and outstanding as of June 30, 2020 and December 31, 2019, respectively

|

|

|

—

|

|

|

|

—

|

|

|

|

Series X Convertible Preferred stock, par value $0.0001, 1,000,000 shares authorized, 0 shares issued and outstanding as of June 30, 2020 and December 31, 2019, respectively

|

|

|

—

|

|

|

|

—

|

|

|

|

Common stock par value $0.0001: 400,000,000 shares authorized; 38,684,514 and 28,912,500 shares issued and outstanding at June 30, 2020 and December 31, 2019, respectively

|

|

|

4

|

|

|

|

3

|

|

|

|

Additional paid-in capital

|

|

|

315,871

|

|

|

|

257,002

|

|

|

|

Accumulated deficit

|

|

|

(210,540

|

)

|

|

|

(56,123

|

)

|

|

|

Non-controlling interest

|

|

|

16,410

|

|

|

|

22,602

|

|

|

|

Accumulated other comprehensive loss

|

|

|

—

|

|

|

|

(770

|

)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total stockholders’ equity

|

|

|

687,869

|

|

|

|

222,714

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

TOTAL LIABILITIES, CONVERTIBLE PREFERRED STOCK AND STOCKHOLDERS’ EQUITY

|

|

$

|

1,110,366

|

|

|

$

|

368,225

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

fuboTV Inc.

Condensed Consolidated Statements of Cash Flows (Unaudited)

(in thousands, except share and per share amounts)

|

|

|

|

|

|

|

|

Six Months Ended June 30,

|

|

|

|

|

2020

|

|

|

2019

|

|

|

|

|

|

|

|

|

|

|

OPERATING ACTIVITIES

|

|

|

|

|

|

|

|

|

|

Net loss

|

|

$

|

(156,098

|

)

|

|

$

|

(6,232

|

)

|

|

Adjustments to reconcile net loss to net cash used in operating activities:

|

|

|

|

|

|

|

|

|

|

Depreciation and amortization

|

|

|

19,637

|

|

|

|

10,316

|

|

|

Stock-based compensation

|

|

|

17,776

|

|

|

|

—

|

|

|

Loss on deconsolidation of Nexway, net of cash retained by Nexway

|

|

|

8,564

|

|

|

|

—

|

|

|

Common stock issued in connection with note payable

|

|

|

67

|

|

|

|

—

|

|

|

Loss on issuance of notes, bonds and warrants

|

|

|

50,806

|

|

|

|

—

|

|

|

Non-cash expense relating to issuance of warrants and common stock

|

|

|

2,208

|

|

|

|

—

|

|

|

Amortization of debt discount

|

|

|

10,981

|

|

|

|

454

|

|

|

Deferred income tax benefit

|

|

|

(4,519

|

)

|

|

|

(2,206

|

)

|

|

Change in fair value of derivative liabilities

|

|

|

526

|

|

|

|

(1,018

|

)

|

|

Change in fair value of warrant liabilities

|

|

|

(4,600

|

)

|

|

|

—

|

|

|

Change in fair value of subsidiary warrant liability

|

|

|

(3

|

)

|

|

|

(3,601

|

)

|

|

Change in fair value of shares settled liability

|

|

|

1,665

|

|

|

|

—

|

|

|

Change in fair value of profit share liability

|

|

|

148

|

|

|

|

—

|

|

|

Unrealized gain on investment

|

|

|

(2,614

|

)

|

|

|

—

|

|

|

Amortization of right-of-use assets

|

|

|

167

|

|

|

|

26

|

|

|

Foreign exchange loss

|

|

|

1,010

|

|

|

|

—

|

|

|

Accrued interest on note payable

|

|

|

246

|

|

|

|

295

|

|

|

Other, net

|

|

|

(31

|

)

|

|

|

—

|

|

|

Changes in operating assets and liabilities:

|

|

|

|

|

|

|

|

|

|

Accounts receivable

|

|

|

792

|

|

|

|

—

|

|

|

Prepaid expenses and other current and long-term assets

|

|

|

(614

|

)

|

|

|

(15

|

)

|

|

Due to related parties

|

|

|

10,889

|

|

|

|

—

|

|

|

Accounts payable, accrued expenses and other current and long-term liabilities

|

|

|

799

|

|

|

|

459

|

|

|

Operating lease liabilities

|

|

|

(162

|

)

|

|

|

(26

|

)

|

|

Deferred revenue

|

|

|

46

|

|

|

|

—

|

|

|

|

|

|

|

|

|

|

|

|

|

Net cash used in operating activities

|

|

|

(42,314

|

)

|

|

|

(1,548

|

)

|

|

|

|

|

|

|

|

|

|

|

|

INVESTING ACTIVITIES

|

|

|

|

|

|

|

|

|

|

Capital expenditures

|

|

|

(70

|

)

|

|

|

(9

|

)

|

|

Investment in Panda Productions (HK) Limited

|

|

|

—

|

|

|

|

(1,000

|

)

|

|

Advance to fuboTV

|

|

|

(10,000

|

)

|

|

|

—

|

|

|

Acquisition of fuboTV’s cash and cash equivalents and restricted cash

|

|

|

9,373

|

|

|

|

—

|

|

|

Sale of profit interest in investment in Panda Productions (HK) Limited

|

|

|

—

|

|

|

|

655

|

|

|

Lease security deposit

|

|

|

—

|

|

|

|

(20

|

)

|

|

|

|

|

|

|

|

|

|

|

|

Net cash used in investing activities

|

|

|

(697

|

)

|

|

|

(374

|

)

|

|

|

|

|

|

|

|

|

|

|

|

FINANCING ACTIVITIES

|

|

|

|

|

|

|

|

|

|

Proceeds from issuance of convertible notes

|

|

|

3,003

|

|

|

|

—

|

|

|

Repayments of convertible notes

|

|

|

(1,140

|

)

|

|

|

(523

|

)

|

|

Proceeds from issuance Series D Preferred Stock

|

|

|

203

|

|

|

|

—

|

|

|

Proceeds from sale of common stock

|

|

|

28,926

|

|

|

|

2,199

|

|

|

Proceeds from sale of subsidiary’s common stock

|

|

|

—

|

|

|

|

65

|

|

|

Redemption of Series D Preferred Stock

|

|

|

(611

|

)

|

|

|

—

|

|

|

Proceeds from short-term borrowings

|

|

|

18,950

|

|

|

|

—

|

|

|

Repayments of short-term borrowings

|

|

|

(8,407

|

)

|

|

|

—

|

|

|

Proceeds from long-term borrowings

|

|

|

4,699

|

|

|

|

—

|

|

|

Repayments of long-term borrowings

|

|

|

(1,250

|

)

|

|

|

—

|

|

|

Proceeds from related parties

|

|

|

—

|

|

|

|

410

|

|

|

Repayments to related parties

|

|

|

(300

|

)

|

|

|

(109

|

)

|

|

|

|

|

|

|

|

|

|

|

|

Net cash provided by financing activities

|

|

|

44,073

|

|

|

|

2,042

|

|

|

|

|

|

|

|

|

|

|

|

|

Net increase in cash and cash equivalents and restricted cash

|

|

|

1,062

|

|

|

|

120

|

|

|

Cash and cash equivalents and restricted cash, beginning of period

|

|

|

7,624

|

|

|

|

31

|

|

|

|

|

|

|

|

|

|

|

|

|

Cash and cash equivalents and restricted cash, end of period

|

|

$

|

8,686

|

|

|

$

|

151

|

|

Key Metrics and Non-GAAP Measures

Paid Subscribers

Total subscribers that have completed registration with fuboTV, have activated a payment method (only reflects one paying user per plan), from which fuboTV has collected payment from in the month ending the relevant period.

Monthly Active Users (MAUs)

Monthly Active Users (MAU) refers to the total count of Paid Subscribers that have consumed content for greater than 10 seconds in the 30-days preceding the period-end indicated.

Content Hours

Content Hours is defined as the sum of total hours of content watched on the fuboTV platform for a given period.

Monthly Content Hours Watched per MAU

Content Hours per MAU refers to the total hours of content viewed by MAUs in a given month divided by the MAU count in the period.

Monthly Average Revenue per User (Monthly ARPU)

ARPU (Average Revenue Per User) is a fuboTV measure defined as total subscriber revenue collected in the period (subscriber and advertising revenues excluding other revenues) divided by the average daily paid subscribers in such period divided by the number of months in the period.

Average Cost Per User (ACPU)

Average Cost Per User (ACPU) reflects variable COGS per user defined as subscriber related expenses less minimum guarantees expensed, payment processing for deferred revenue, IAB fees for deferred revenue and other subscriber related expenses in a given period, divided by the average daily subscribers in the period, divided by the number of months in the period.

Adjusted Contribution Margin

Adjusted Contribution Margin (ACM) is a non-GAAP figure to measure the variable costs against subscriber revenue. ACM is calculated by subtracting ACPU from ARPU.

Reconciliation of Non-GAAP Financial Measures

Our non-GAAP financial measures have limitations as analytical tools and you should not consider them in isolation or as a substitute for an analysis of our results under GAAP. There are a number of limitations related to the use of these non-GAAP financial measures versus their nearest GAAP equivalents. First, these non-GAAP financial measures are not a substitute for GAAP revenue. Second, these non-GAAP financial measures may not provide information directly comparable to measures provided by other companies in our industry, as those other companies may calculate their non-GAAP financial measures differently.

The following table reconciles the most directly comparable GAAP financial measure to the non-GAAP financial measure.

|

|

|

Three Months Ended

|

|

June 30, 2020

|

|

(in thousands) |

|

|

|

Revenue Recognized (GAAP)

|

$

|

44,172

|

|

|

|

| Subtract: |

|

| Other Revenue |

|

(337

|

)

|

| Portion of Prior Quarter Deferred Revenue to be Recognized in the Current Quarter |

|

(8,066

|

)

|

|

|

| Add: |

|

| Portion of Deferred Revenue to be Recognized in the Next Quarter |

|

8,332

|

|

|

Subscriber Revenue

|

|

44,101

|

|

|

|

|

|

|

Three Months Ended

|

|

June 30, 2020

|

|

(in thousands) |

|

|

|

Subscriber Related Expenses (GAAP)

|

$

|

53,087

|

|

|

|

| Add: |

|

| Payment Processing for Current Qtr Sub Revenue |

|

202

|

|

| IAB fees for Current Qtr Sub Revenue |

|

42

|

|

|

|

| Subtract: |

|

| Minimum Guarantees Expensed |

|

(10,222

|

)

|

| Payment Processing for Prior Qtr Sub Revenue |

|

(161

|

)

|

| IAB fees for Prior Qtr Sub Revenue |

|

(41

|

)

|

| Other SRE |

|

(1,055

|

)

|

|

Variable COGS

|

|

41,852

|

|

|

|

| Subscriber Revenue |

$

|

44,101

|

|

| Variable COGS |

|

(41,852

|

)

|

|

Adjusted Contribution Margin

|

|

2,249

|

|

|

Adjusted Contribution Margin as a Percentage of Subscriber Revenue

|

|

5.1

|

%

|

|

|

|

|

|

Three Months Ended

|

|

June 30, 2020

|

|

June 30, 2019

|

|

|

|

Pro Forma

|

|

Reconciliation of Operating Expenses to Adjusted Operating Expenses

|

|

|

|

| Operating Expenses |

$

|

111,462

|

|

|

$

|

74,483

|

|

| Depreciation and amortization |

|

(14,417

|

)

|

|

|

(5,158

|

)

|

| One-time non-cash operating expenses |

|

(5,379

|

)

|

|

|

-

|

|

| Stock-based Compensation |

|

(5,545

|

)

|

|

|

-

|

|

| Adjusted Operating Expenses |

|

86,121

|

|

|

|

69,325

|

|

|

|

|

|

|

Three Months Ended

|

|

June 30, 2020

|

|

June 30, 2019

|

|

|

|

Pro Forma

|

|

Reconciliation of Net Loss to Adjusted EBITDA:

|

|

|

|

| Net Loss |

$

|

(99,755

|

)

|

|

$

|

(42,965

|

)

|

| Depreciation and amortization |

|

14,417

|

|

|

|

5,158

|

|

| Stock-based Compensation |

|

5,545

|

|

|

|

-

|

|

| One-time non-cash operating expenses |

|

5,379

|

|

|

|

-

|

|

| Other income (expense) |

|

35,946

|

|

|

|

(1,560

|

)

|

| Provision for income taxes (income tax benefit) |

|

(3,481

|

)

|

|

|

(1,037

|

)

|

| Adjusted EBITDA |

|

(41,949

|

)

|

|

|

(40,404

|

)

|

View source version on businesswire.com:

https://www.businesswire.com/news/home/20200813005707/en/

Investors:

The Blueshirt Group for fuboTV

ir@fubo.tv

Media:

Jennifer L. Press, fuboTV

jpress@fubo.tv

Katie Minogue, fuboTV

kminogue@fubo.tv

Source: fuboTV Inc.